Page 66 - 33rd Edition GAIF Pre-Conference May 2022 Issue 606

P. 66

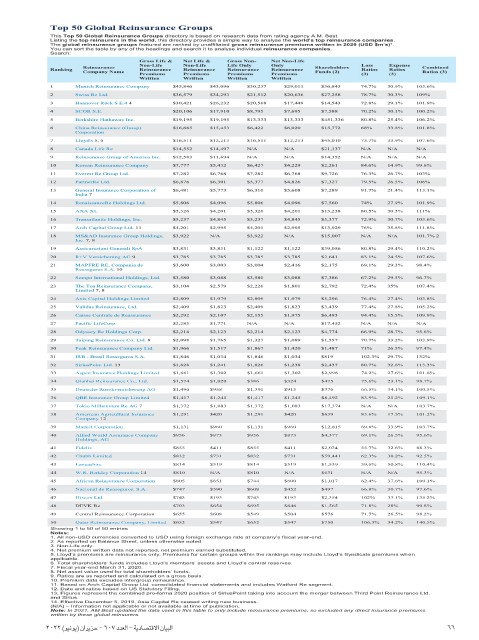

33 Aspen Insurance Holdings Limited $1,661 $1,302 $1,661 $1,302 $2,998 74.2% 27.6% 101.8%

34 Qianhai Reinsurance Co., Ltd. $1,574 $1,020 $386 $324 $475 75.6% 23.1% 98.7%

35 Deutsche Rueckversicherung AG $1,490 $958 $1,391 $915 $376 66.5% 34.1% 100.5%

36 QBE Insurance Group Limited $1,417 $1,245 $1,417 $1,245 $8,492 83.9% 25.2% 109.1%

37 Tokio Millennium Re AG 7 $1,372 $1,083 $1,372 $1,083 $17,374 N/A N/A 103.7%

38 American Agricultural Insurance $1,291 $420 $1,291 $420 $639 83.6% 17.5% 101.2%

Company 12

39 Markel Corporation $1,131 $960 $1,131 $960 $12,815 69.8% 33.9% 103.7%

40 Allied World Assurance Company $956 $873 $956 $873 $4,377 69.1% 26.5% 95.6%

Holdings, AG

41 Fidelis $855 $411 $855 $411 $2,034 55.7% 32.6% 88.3%

42 Chubb Limited $832 $731 $832 $731 $59,441 62.3% 30.2% 92.5%

43 Lancashire $814 $519 $814 $519 $1,539 59.6% 50.8% 110.4%

44 W.R. Berkley Corporation 14 $810 N/A $810 N/A $631 N/A N/A 95.3%

45 African Reinsurance Corporation $805 $651 $744 $600 $1,017 62.4% 37.6% 100.1%

46 Nacional de Reaseguros, S.A. $747 $590 $608 $452 $497 66.8% 30.7% 97.6%

47 Hiscox Ltd. $743 $193 $743 $193 $2,354 102% 33.1% 135.2%

48 DEVK Re $703 $654 $695 $646 $1,565 71.8% 28% 99.8%

49 Central Reinsurance Corporation $655 $608 $549 $504 $576 71.7% 26.5% 98.2%

50 Qatar Reinsurance Company, Limited $652 $547 $652 $547 $750 106.3% 34.2% 140.5%

Showing 1 to 50 of 50 entries

Notes:

1. All non-USD currencies converted to USD using foreign exchange rate at company’s fiscal year-end.

2. As reported on Balance Sheet, unless otherwise noted.

3. Non-Life only.

4. Net premium written data not reported, net premium earned substituted.

5. Lloyd’s premiums are reinsurance only. Premiums for certain groups within the rankings may include Lloyd’s Syndicate premiums wh en

applicable.

6. Total shareholders’ funds includes Lloyd’s members’ assets and Lloyd’s central reserves.

7. Fiscal year-end March 31, 2020.

8. Net asset value used for total shareholders’ funds.

9. Ratios are as reported and calculated on a gross basis.

10. Premium data excludes intergroup reinsurance.

11. Based on Arch Capital Group Ltd. consolidated financial statements and includes Watford Re segment.

12. Data and ratios based on US Statutory Filing.

13. Figures represent the combined pro-forma 2020 position of SiriusPoint taking into account the merger between Third Point Reinsurance Ltd.

and Sirius.

14. Effective December 5, 2019, Asia Capital Re ceased writing new business.

(N/A) – Information not applicable or not available at time of publication.

Note: In 2021, AM Best updated the data used in this table to only include reinsurance premiums, so excluded any direct insurance p remiums

written by these global reinsurers.

2022 (ƒ«fƒj) ¿GôjõM - 607 O~©dG - ájOÉ°üàb’G ¿É«ÑdG 66